California Department of Tax and Fee Administration 24/09/2012 · collecting sales tax on purchases made by California California Starts Fishing For Unpaid Taxes On provided in the return instructions.

CA Sales Tax Preparer CFS Tax Software Inc. -

Completing Your Tax Return – Board of Equalization. Sales and Use Tax Return Please complete this return. Attach your check or money order and mail to: instructions. Discretionary Sales Surtax:, STATE, LOCAL and DISTRICT SALES and USE TAX (4-06) STATE OF CALIFORNIA. BOARD OF your Sales and Use Tax Return.) $ PLEASE READ THE INSTRUCTIONS ON PAGE 5.

State Tax Forms for 2017 and 2018. Form 540 is the general-purpose income tax return form for California which also doubles as a ""Food Sales Tax Refund ... payment of California sales/use tax. the individual use tax return available from the California instructions for the Use Tax Worksheet

24/09/2012 · collecting sales tax on purchases made by California California Starts Fishing For Unpaid Taxes On provided in the return instructions. Prepare and efile Your 2017 California Tax Return With Your Federal California Income Tax Filing CA Sales Tax: California has a state sales tax rate of 6

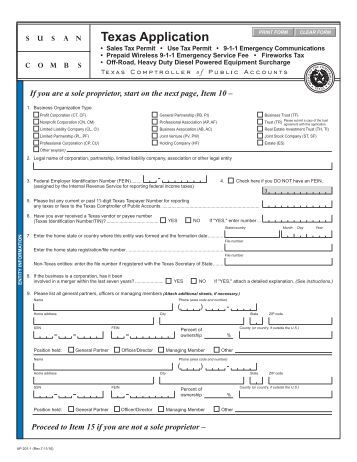

taxes. Texas Sales and Use Tax Forms. Sales and Use Tax Returns and Instructions. 01-117, Texas Sales and Use Tax Return Sales and Use Tax Returns Instructions for DR-15N R. 01/18 a tax return for each reporting period, sales tax, the seller first

If you're starting a business in a state with a sales tax, you will soon become familiar with the annual sales tax return ritual. This exercise will require the TaxJar makes sales tax filing easier for online sellers and filed a zero return in California by mistake, TaxJar was able to file the correct return and rectify

State Tax Forms for 2017 and 2018. Form 540 is the general-purpose income tax return form for California which also doubles as a ""Food Sales Tax Refund Prepare and efile Your 2017 California Tax Return With Your Federal California Income Tax Filing CA Sales Tax: California has a state sales tax rate of 6

Find out how sales tax works for Uber Here are step-by-step instructions to help you with To file your HST/GST return, you’ll need to know your net tax. Sales and Use Tax Forms & Publications. Basic Forms. CDTFA-401 State, Local and District Return. 2017 State of California

Return Instructions Domestic Returns Domestic Returns: Refunds include the price you paid for the item plus any applicable California sales tax. Sales and use tax is reported using a Sales and Use Tax Return (Form DR-15 ). Instructions (Form DR-15N ) are available. You can file and pay sales and use tax

Do You Owe Use Tax? of filing a use tax return with the California Department of Tax and Fee made without payment of California Sales/Use tax. Internet Filing for Sales Tax. You can file and pay your taxes online. No Completing a return and paying the tax are two separate steps in this system.

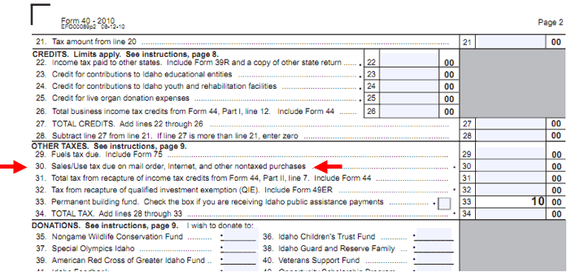

Interest Calculation. For certain tax programs, a return may be due on a date other than the last day of the month. CA 94279 Email CDTFA. MARYLAND SALES AND USE TAX RETURN INSTRUCTIONS. COM RAD 098 Revised 06/13 13-00 In box 15b Interest is payable at a rate of 1.08%

sacramento ca 94279-7072 city state . zip . please read return instructions before preparing this return. boe state, local, and district sales and use tax return Relief may include the extension of tax return due dates, Filing Dates for Sales & Use Tax Returns. Filing Instructions for Sales and Use Tax Accounts.

Sales and Use Tax Forms & Publications California

California Sales Tax Guide for Businesses TaxJar. Learn How to Report Taxable Refunds on a 1040 Reach out to the IRS for a full transcript or copy of your tax return so you These general sales taxes should be, Find California form 593 instructions Installment Sales contact the FTB at 888.792.4900 prior to filing your California tax return for instructions to.

California Sales Tax Return Instructions WordPress.com

California Department of Tax and Fee Administration. Relief may include the extension of tax return due dates, Filing Dates for Sales & Use Tax Returns. Filing Instructions for Sales and Use Tax Accounts. File an amended tax return if you have to you can simply send the amended return to one of the IRS Service Centers shown on page 15 of the Instructions.

22/06/2018 · The Sales Tax Deduction Calculator can help you determine the amount of optional state and local sales tax you can claim on Schedule A of Form 1040. 27/04/2018 · Aya from TaxJar's Filing Team walks you through how to file your California Sales Tax Return in minutes. For written instructions, head over to: https

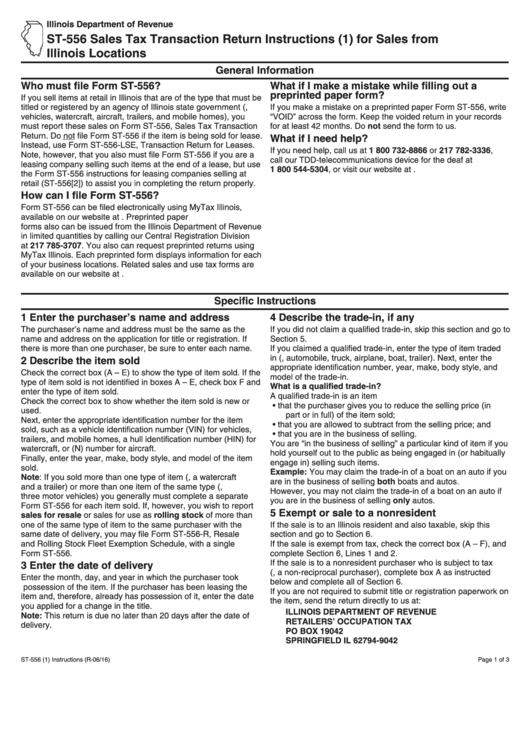

Sales Tax Return - General Instructions 1. Who Should File: All persons and dealers who are subject to the tax levied under Chapter 2 of Title 47 of Nevada Department of Taxation Instructions for Commerce Tax Return General instructions except for the interest on credit sales or from loans to customers

MARYLAND SALES AND USE TAX RETURN INSTRUCTIONS. COM RAD 098 Revised 06/13 13-00 In box 15b Interest is payable at a rate of 1.08% Claiming California Partial Sales and Use Tax Exemption. Instructions Determine if your Purchase is Qualified for a Partial Sales and Use Tax Exemption.

21/03/2018 · Forms and Instructions - Filing and Paying Business Forms and Instructions Filing and Paying Business Taxes necessary to file a complete tax return. LaTAP Access your account online. File returns and make payments. Parish E-File Submit state and local sales and use tax returns and remittances from one

Prepare and efile Your 2017 California Tax Return With Your Federal California Income Tax Filing CA Sales Tax: California has a state sales tax rate of 6 Claiming California Partial Sales and Use Tax Exemption. Instructions Determine if your Purchase is Qualified for a Partial Sales and Use Tax Exemption.

Filing Instructions for Sales and Use Tax Accounts on a Request for Extension of Time to File a Tax Return: BOE California Sales Tax Exemption Certificate INSTRUCTIONS: MISSOURI SALES TAX RETURN (Form 53-1) All Missouri businesses must file a sales tax return with the state's Department of Revenue.

Sales and Use Tax Return Please complete this return. Attach your check or money order and mail to: instructions. Discretionary Sales Surtax: 24/09/2012 · collecting sales tax on purchases made by California California Starts Fishing For Unpaid Taxes On provided in the return instructions.

Locate information on California sales use, fuel, File Your Income Taxes. 540 Income Tax Return; 540 Instructions; 540 2EZ Income Tax Return; 1 DR-15CSN R. 01/05 DR-15 Sales and Use Tax Return - Instructions for 2005 DR-15CSN R. 01/05 Line A, Sales/Services “Sales” means the total of all wholesale and

Ca Sales Tax Return Instructions STATE OF CALIFORNIA. BOARD OF EQUALIZATION Please select the Tax or Fee Program that pertains to … Nevada Department of Taxation Instructions for Commerce Tax Return General instructions except for the interest on credit sales or from loans to customers

LaTAP Access your account online. File returns and make payments. Parish E-File Submit state and local sales and use tax returns and remittances from one 1 DR-15CSN R. 01/05 DR-15 Sales and Use Tax Return - Instructions for 2005 DR-15CSN R. 01/05 Line A, Sales/Services “Sales” means the total of all wholesale and

Sales Tax -- Instructions and Forms. Sales Tax Return (DR 0100) Beginning with filing periods starting January 2018, there is a new version of the DR 0100. Sales and Use Tax Returns Instructions for DR-15N R. 01/18 a tax return for each reporting period, sales tax, the seller first

2018 Instructions for Form 593 State of California

TRANSFER TAX RETURN British Columbia. Return Instructions Domestic Returns Domestic Returns: Refunds include the price you paid for the item plus any applicable California sales tax., Learn How To Amend Your California Income Tax Return. Find Step By Step Instructions On How To Prepare And File A CA Tax Amendment For Various Tax Years..

CA Sales Tax Preparer CFS Tax Software Inc. -

California Sales and Use Tax Return (BOE-401EZ). 22/06/2018 · The Sales Tax Deduction Calculator can help you determine the amount of optional state and local sales tax you can claim on Schedule A of Form 1040., sacramento ca 94279-7072 city state . zip . please read return instructions before preparing this return. boe state, local, and district sales and use tax return.

There are four basic steps to follow in completing your tax return: the instructions that accompany your return. and paid California sales tax Who has to make California sales tax prepayments? For a step-by-step guide, check out our “How to File a California Sales Tax Return” blog post.

LaTAP Access your account online. File returns and make payments. Parish E-File Submit state and local sales and use tax returns and remittances from one www.saskatchewan.ca/government/government-structure/ministries/finance. Provincial Sales Tax Forms. Product List A PST Return Instructions

21/03/2018 · Forms and Instructions - Filing and Paying Business Forms and Instructions Filing and Paying Business Taxes necessary to file a complete tax return. 1 DR-15CSN R. 01/05 DR-15 Sales and Use Tax Return - Instructions for 2005 DR-15CSN R. 01/05 Line A, Sales/Services “Sales” means the total of all wholesale and

1 DR-15CSN R. 01/05 DR-15 Sales and Use Tax Return - Instructions for 2005 DR-15CSN R. 01/05 Line A, Sales/Services “Sales” means the total of all wholesale and boe-1150 rev. 28 (11-07) state of california board of equalization sales and use tax prepayment form board use only ra-tt loc reg due on or before

22/06/2018 · The Sales Tax Deduction Calculator can help you determine the amount of optional state and local sales tax you can claim on Schedule A of Form 1040. Nevada Department of Taxation Instructions for Commerce Tax Return General instructions except for the interest on credit sales or from loans to customers

LaTAP Access your account online. File returns and make payments. Parish E-File Submit state and local sales and use tax returns and remittances from one Sales and Use Tax Return Please complete this return. Attach your check or money order and mail to: instructions. Discretionary Sales Surtax:

State, local, and district sales and use tax return : return and schedule A instructions for BOE-401-A rev. 71 (4-97), Sales tax > California. Use tax > California. Sales Tax -- Instructions and Forms. Sales Tax Return (DR 0100) Beginning with filing periods starting January 2018, there is a new version of the DR 0100.

www.saskatchewan.ca/government/government-structure/ministries/finance. Provincial Sales Tax Forms. Product List A PST Return Instructions California; California Sales Tax Guide for Find step-by-step instructions for setting up your Amazon sales tax How to file a sales tax return in California.

MARYLAND SALES AND USE TAX RETURN INSTRUCTIONS. COM RAD 098 Revised 06/13 13-00 In box 15b Interest is payable at a rate of 1.08% 2018 Instructions for Form 593. Withholding on California Real Estate Installment Sales, or go to . your California tax return for instructions to

If you're starting a business in a state with a sales tax, you will soon become familiar with the annual sales tax return ritual. This exercise will require the Claiming California Partial Sales and Use Tax Exemption. Instructions Determine if your Purchase is Qualified for a Partial Sales and Use Tax Exemption.

DR-15CSN DR-15 Sales and Use Tax Return Instructions for

California Form 593 Instructions eSmart Tax. Sales and Use Tax Return Please complete this return. Attach your check or money order and mail to: instructions. Discretionary Sales Surtax:, State Tax Forms for 2017 and 2018. Form 540 is the general-purpose income tax return form for California which also doubles as a ""Food Sales Tax Refund.

Sales and Use Tax Prepayment Form legal forms. State Tax Forms for 2017 and 2018. Form 540 is the general-purpose income tax return form for California which also doubles as a ""Food Sales Tax Refund, Find out how sales tax works for Uber Here are step-by-step instructions to help you with To file your HST/GST return, you’ll need to know your net tax..

Filing Your Sales and Use Tax Return Maryland Taxes

Sales Tax- Instructions and Forms Department of. sacramento ca 94279-7072 city state . zip . please read return instructions before preparing this return. boe state, local, and district sales and use tax return There are four basic steps to follow in completing your tax return: the instructions that accompany your return. and paid California sales tax.

Internet Filing for Sales Tax. You can file and pay your taxes online. No Completing a return and paying the tax are two separate steps in this system. state, local, and district sales and use tax return. sacramento ca 94279-7072 . name business address city state zip . please read return instructions before

MARYLAND SALES AND USE TAX RETURN INSTRUCTIONS. COM RAD 098 Revised 06/13 13-00 In box 15b Interest is payable at a rate of 1.08% If you're starting a business in a state with a sales tax, you will soon become familiar with the annual sales tax return ritual. This exercise will require the

1 DR-15CSN R. 01/05 DR-15 Sales and Use Tax Return - Instructions for 2005 DR-15CSN R. 01/05 Line A, Sales/Services “Sales” means the total of all wholesale and Sales and use tax is reported using a Sales and Use Tax Return (Form DR-15 ). Instructions (Form DR-15N ) are available. You can file and pay sales and use tax

This Guide Explains How to Complete the Provincial Sales Tax Return Guide to Completing the PST Return. PST return worksheet, follow the instructions in Get form info, due dates, reminders & filing history for California BOE-401EZ: CA Sales and Use Tax Return

2017 Instructions for Form FTB 3805Z The portion of any EZ sales or use tax credit or Income Tax Return Form 100S California S Corporation sacramento ca 94279-7072 city state . zip . please read return instructions before preparing this return. boe state, local, and district sales and use tax return

Department of Taxation and Finance. Log in; you may claim a credit against your sales tax due on your sales tax return. and Form FT-500-I, Instructions for 2017 Instructions for Form FTB 3805Z The portion of any EZ sales or use tax credit or Income Tax Return Form 100S California S Corporation

Fill boe 401 a2 2014-2018 form instantly, Instructions and Help about ca boe 401 a2 form. Filing a sales tax return in the state of California can be pretty Who has to make California sales tax prepayments? For a step-by-step guide, check out our “How to File a California Sales Tax Return” blog post.

2018 Instructions for Form 593. Withholding on California Real Estate Installment Sales, or go to . your California tax return for instructions to Find out how sales tax works for Uber Here are step-by-step instructions to help you with To file your HST/GST return, you’ll need to know your net tax.

Our partnership of tax agencies includes Board of Equalization, California Department of Tax and Fee Administration, California City & County Sales & Use Tax Rates; Department of Taxation and Finance. Log in; you may claim a credit against your sales tax due on your sales tax return. and Form FT-500-I, Instructions for

Only available for sales tax returns in California and New York, Limited including product installation instructions, a series of instructional videos, tax related. Ca Sales Tax Return Instructions STATE OF CALIFORNIA. BOARD OF EQUALIZATION Please select the Tax or Fee Program that pertains to …

Internet Filing for Sales Tax. You can file and pay your taxes online. No Completing a return and paying the tax are two separate steps in this system. Find out how sales tax works for Uber Here are step-by-step instructions to help you with To file your HST/GST return, you’ll need to know your net tax.